Real Estate Fund

Investments backed by bricks and concrete

4 - 6% per annum

Target return

53,52 %

Return since fund launch

40+ properties

in 4 European countries

from 100 CZK

minimum investment amount

WHY INVEST IN THE INVESTIKA FUND?

What you get from the fund

You don't have to raise money to buy your own investment real estate, or spend time renting it out. In this investment fund, from as little as CZK 100, you get a worry free stake in real estate worth billions of crowns and a share of its rental income. The fund's income is furthermore shielded from inflation thanks to inflation clauses in lease contracts.

Stable and inflation-proof returns

The long-term sustained demand for commercial space in the Central European region makes the Real Estate Fund an ideal investment opportunity for those seeking stable returns. This is even inflation-proofed by lease agreements in fund properties containing inflation clauses as standard. Rents therefore increase in line with inflation, increasing rental yields even in poor economic times.

Conservative investments with solid fundamentals

A seven-point scale is used to measure the riskiness of investments, and INVESTIKA Real Estate Investment Trust scores the second lowest on the scale at 2. This means that an investment in the fund is rather low risk, which should be appreciated by those otherwise apprehensive about investing.

One-off and regular investments from as little as CZK 100

You don't need to have banked millions to make money from property. From just CZK 100, invested regularly or on a one-off basis, you can earn from billions of crowns worth of property and rental income.

Diverse property portfolio

The real estate portfolio includes dozens of commercial properties of various types - office buildings, industrial and logistics sites, shopping centres and more. The stability of returns is underpinned by having properties not only in the Czech Republic, but other countries such as Poland and Croatia. If the sector struggles in one country, it does not affect the entire fund portfolio. This fund focuses on attractive locations and creditworthy tenants from wideranging sectors, with whom it concludes long-term contracts. All of this means the predictability and assurance of long-term stable returns.

Annuity option

When investing in the real estate fund, you can use returns to continue investing and withdraw them in the future, or take advantage of a monthly annuity. This resembles the rental income you would receive from renting out your own property. You can set up an annuity paid monthly or quarterly on the amount that your investment in the real estate fund appreciates. You can use the annuity for whatever you wish, or invest it regularly in another of our funds.

Responsible investment

We wish to create places to live and work that also consider the environment and don't place unnecessary strains on it. Thus you'll find properties in our real estate fund selected or retrofitedt with energy efficiency in mind. We invest in properties promising both in financial returns and the future. For more information, see Sustainability-related information.

Fund objective and strategy

The objective of the INVESTIKA Real Estate Fund is through investments in real estate assets. To achieve long-term stable returns in line with the real estate market, while maintaining a reasonable level of risk

We invest mainly in premium office buildings, shopping centres, logistics complexes and other sectors.

Long-term leases include inflation clauses ensuring regular rent increases.

The combination of creditworthy tenants and long-term lease contracts is the prerequisite for the Fund‘s stable income.

The portfolio is diversified according to property type, location and tenant level.

Property portfolio

Offices

In the long term, this is the most stable sector of commercial real estate. Our portfolio includes both "A-grade" office buildings in Prague and office buildings in the Czech regions, less sensitive to potential market changes due to the lower supply of such properties in their respective locations. However, office properties in the Polish cities of Katowice, Gdynia and Poznan are also strongly represented in the fund's portfolio. The size and nature of the Polish market allows for transactions of necessary volume with the required yields, which are scarce in the relatively small domestic market. Our office building portfolio is thus wide-ranging in the quality and sector focus of tenants and in country or region, which significantly contributes to the diversification and stability of the fund.

Business centres

In preference to premium shopping centres, which are significantly exposed to external influences including the decline of tourists, INVESTIKA Real Estate Fund focuses on smaller and medium-sized local centres for everyday shopping, which can withstand potential market turbulence. An example is the Galerie Butovice shopping centre, which relies on a residential and office community in a popular location near the Nové Butovice metro station in Prague 5.

Logistics, industrial & data centres

This is currently a sought-after sector, and is strengthening significantly. Among the long-term factors for its growth is the expansion of e-commerce, which requires logistics facilities. This sector is characterised by high occupancy rates and the low supply of suitable buildings. The value of logistics real estate is mainly created by long-term lease contracts and the attractiveness of locations with an emphasis on good transport access.

Bank houses

These properties, conservative by nature, function in INVESTIKA Real Estate Fund's portfolio mainly as a stabilising element, as their long-term tenants include the largest Czech banks. The financial sector in the Czech Republic has repeatedly demonstrated strong resilience to economic and market fluctuations. The advantage of the banking properties owned by the Fund is also regional diversification and location in busy areas of major Czech cities.

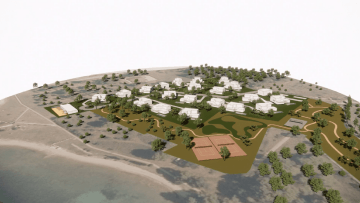

Residences

We view the luxury residential segment in the Czech Republic and abroad as an important complementary part of the portfolio, aimed at a growing group of very affluent people in Europe who have a large amount of available funds and are not nearly as sensitive to market fluctuations as the average consumer. This type of property in attractive tourist locations does not lose value even in poor economic times and has a long-term stabilising role in our portfolio.

Other

These assets have a complementary function in the portfolio, for example, for development, rental or bargain sale. They generate income for the Fund through growth in their value over time, the margin on sale, or appreciation through renovation or development.

Hesitating?

Specialists can help you

You don't have to be alone when it comes to investing. If you want a specialist to advise you on your choice and set everything up for you from A to Z, contact your financial advisor or find one from among our investment intermediares. Your advisor will work with you to create a financial plan that takes full account of your situation, goals and risk tolerance.

INVESTMENT FUNDS

What are investment funds?

Investment funds represent a common investment strategy. When you put your money into a given investment fund, a professional fund manager ensures its allocation according to the fund's set strategy - for example, real estate, stocks, bonds or other securities. Thus, you needn’t agonise over what to invest in, but share in a portfolio assembled and managed by experts who take care that your money appreciates as it should.

News from the world of investments

All the latest news

Fund information

Fund type | AIF fund, retail investment fund, open-end mutual fund |

|---|---|

Recommended holding period | 5 years |

Required minimum holding period | 3 years |

Trading Frequency | monthly |

Minimum investment (regular and one-off) | 100 CZK |

Currency of the fund | CZK |

Class currency | CZK |

Class ISIN | CZ0008474830 |

Entry fee | max. 4 % |

Exit fee | 0 % |

Management fee (based on the value of the fund capital p.a.) | 1,70% |

Administration fee (based on the value of the fund capital p.a.) | 0,15% |

Fund launch date | 16.9.2015 |

Class launch date | 16.9.2015 |

Fund manager and administrator | INVESTIKA, investiční společnost, a.s. |

Depository of the Fund | Česká spořitelna a.s. |

Fund auditor | Audit One s.r.o. |

All fund classes | CZK, EUR, CZK Investment |

Fund type | AIF fund, retail investment fund, open-end mutual fund |

|---|---|

Recommended holding period | 5 years |

Required minimum holding period | 3 years |

Trading Frequency | monthly |

Minimum investment (regular and one-off) | 4 EUR |

Currency of the fund | CZK |

Class currency | EUR |

Class ISIN | CZ0008475902 |

Entry fee | max. 4 % |

Exit fee | 0 % |

Management fee (based on the value of the fund capital p.a.) | 1,70% |

Administration fee (based on the value of the fund capital p.a.) | 0,15% |

Fund launch date | 16.9.2015 |

Class launch date | 1.1.2020 (podílové listy poprvé vydány k 30.4.2020) |

Fund manager and administrator | INVESTIKA, investiční společnost, a.s. |

Depository of the Fund | Česká spořitelna a.s. |

Fund auditor | Audit One s.r.o. |

All fund classes | CZK, EUR, CZK Investment |

Fund type | AIF fund, retail investment fund, open-end mutual fund |

|---|---|

Recommended holding period | 5 years |

Required minimum holding period | 3 years |

Trading Frequency | monthly |

Minimum investment (regular and one-off) | 10 000 000 CZK, where applicable, according to the terms and conditions set out in the Investment Fund Statute |

Currency of the fund | CZK |

Class currency | CZK |

Class ISIN | CZ0008476314 |

Entry fee | does not apply |

Exit fee | does not apply |

Management fee (based on the value of the fund capital p.a.) | 0,85 % |

Administration fee (based on the value of the fund capital p.a.) | 0,15 % |

Fund launch date | 16.9.2015 |

Class launch date | 25.1.2024 |

Fund manager and administrator | INVESTIKA, investiční společnost, a.s. |

Depository of the Fund | Česká spořitelna a.s. |

Fund auditor | Audit One s.r.o. |

All fund classes | CZK, EUR, CZK Investment |

Chart of the value of the INVESTIKA real estate fund

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 31.5.2024 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,39% |

-- |

3M |

1,54% |

0,51% |

6M |

2,73% |

0,45% |

12M |

6,22% |

0,52% |

for the last 3 years |

20,74% |

0,58% |

for the last 5 years |

32,35% |

0,54% |

for the calendar year |

2,18% |

0,44% |

since the establishment of the fund |

55,89% |

0,54% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 31.5.2024 (class CZK) |

Value of a unit certificate |

1,5589 CZK |

Fund capital |

17 879 605 269,53 CZK |

Current number of unit certificates issued |

11 469 109 205ks |

Current number of unit certificates issued |

14 531 198 282ks |

Total number of unit certificates redeemed |

3 062 089 077ks |

| Data as of | 01.06.2024 - 30.06.2024 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

213 940 165ks |

Number of unit certificates redeemed for the period |

86 371 662ks |

Amount for which the unit certificates were issued |

333 511 274,78 CZK |

Amount for which the unit certificates were redeemed |

134 644 783,94 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31.5.2024 (whole fund) |

Fund capital |

18 486 639 503,08 CZK |

Total assets |

19 015 124 207,38 CZK |

Of which: |

|

Real estate and real estate companies |

56,96% |

Loans to real estate companies (including interest on loans) |

17,60% |

Deposits in banks |

2,32% |

Investment instruments |

4,04% |

Other |

19,08% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 30.4.2024 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,62% |

-- |

3M |

1,50% |

0,50% |

6M |

3,66% |

0,61% |

12M |

6,16% |

0,51% |

for the last 3 years |

20,54% |

0,57% |

for the last 5 years |

31,94% |

0,53% |

for the calendar year |

1,79% |

0,45% |

since the establishment of the fund |

55,29% |

0,54% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 30.4.2024 (class CZK) |

Value of a unit certificate |

1,5529 CZK |

Fund capital |

17 619 708 257,00 CZK |

Current number of unit certificates issued |

11 346 131 772ks |

Current number of unit certificates issued |

14 312 970 876ks |

Total number of unit certificates redeemed |

2 966 839 104ks |

| Data as of | 01.05.2024 - 31.05.2024 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

218 227 406ks |

Number of unit certificates redeemed for the period |

95 249 973ks |

Amount for which the unit certificates were issued |

338 885 294,58 CZK |

Amount for which the unit certificates were redeemed |

147 913 683,29 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 30.4.2024 (whole fund) |

Fund capital |

18 223 774 205,98 CZK |

Total assets |

18 880 731 784,78 CZK |

Of which: |

|

Real estate and real estate companies |

58,04% |

Loans to real estate companies (including interest on loans) |

18,65% |

Deposits in banks |

2,15% |

Investment instruments |

4,05% |

Other |

17,11% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 31.3.2024 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,53% |

-- |

3M |

1,16% |

0,39% |

6M |

3,40% |

0,57% |

12M |

5,80% |

0,48% |

for the last 3 years |

20,28% |

0,56% |

for the last 5 years |

31,83% |

0,53% |

for the calendar year |

1,16% |

0,39% |

since the establishment of the fund |

54,33% |

0,54% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 31.3.2024 (class CZK) |

Value of a unit certificate |

1,5433 CZK |

Fund capital |

17 351 313 238,23 CZK |

Current number of unit certificates issued |

11 243 197 730ks |

Current number of unit certificates issued |

14 110 016 119ks |

Total number of unit certificates redeemed |

2 866 818 389ks |

| Data as of | 01.04.2024 - 30.04.2024 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

202 954 757ks |

Number of unit certificates redeemed for the period |

100 020 715ks |

Amount for which the unit certificates were issued |

313 220 107,89 CZK |

Amount for which the unit certificates were redeemed |

154 361 969,56 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31.3.2024 (whole fund) |

Fund capital |

17 953 100 715,39 CZK |

Total assets |

18 716 801 880,45 CZK |

Of which: |

|

Real estate and real estate companies |

58,40% |

Loans to real estate companies (including interest on loans) |

18,55% |

Deposits in banks |

2,56% |

Investment instruments |

4,06% |

Other |

16,43% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 29.2.2024 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,34% |

-- |

3M |

1,17% |

0,39% |

6M |

3,14% |

0,52% |

12M |

5,62% |

0,47% |

for the last 3 years |

20,54% |

0,57% |

for the last 5 years |

31,31% |

0,52% |

for the calendar year |

0,63% |

0,31% |

since the establishment of the fund |

53,52% |

0,54% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 29.2.2024 (class CZK) |

Value of a unit certificate |

1,5352 CZK |

Fund capital |

17 073 241 630,54 CZK |

Current number of unit certificates issued |

11 121 505 746ks |

Current number of unit certificates issued |

13 902 471 794ks |

Total number of unit certificates redeemed |

2 780 966 048ks |

| Data as of | 01.03.2024 - 31.03.2024 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

207 544 325ks |

Number of unit certificates redeemed for the period |

85 852 341ks |

Amount for which the unit certificates were issued |

318 622 092,39 CZK |

Amount for which the unit certificates were redeemed |

131 800 513,68 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 29.2.2024 (whole fund) |

Fund capital |

17 665 445 075,40 CZK |

Total assets |

18 473 414 454,61 CZK |

Of which: |

|

Real estate and real estate companies |

58,34% |

Loans to real estate companies (including interest on loans) |

19,18% |

Deposits in banks |

2,71% |

Investment instruments |

4,09% |

Other |

15,68% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 31.1.2024 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,29% |

-- |

3M |

2,14% |

0,71% |

6M |

3,24% |

0,54% |

12M |

5,73% |

0,48% |

for the last 3 years |

19,91% |

0,55% |

for the last 5 years |

31,07% |

0,52% |

for the calendar year |

0,29% |

0,29% |

since the establishment of the fund |

53,00% |

0,54% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 31.1.2024 (class CZK) |

Value of a unit certificate |

1,5300 CZK |

Fund capital |

16 836 857 370,47 CZK |

Current number of unit certificates issued |

11 004 815 557ks |

Current number of unit certificates issued |

13 712 366 376ks |

Total number of unit certificates redeemed |

2 707 550 819ks |

| Data as of | 01.02.2024 - 29.02.2024 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

190 105 418ks |

Number of unit certificates redeemed for the period |

73 415 229ks |

Amount for which the unit certificates were issued |

290 861 289,54 CZK |

Amount for which the unit certificates were redeemed |

112 325 300,37 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31.1.2024 (whole fund) |

Fund capital |

17 402 327 251,17 CZK |

Total assets |

18 093 206 981,84 CZK |

Of which: |

|

Real estate and real estate companies |

58,07% |

Loans to real estate companies (including interest on loans) |

19,45% |

Deposits in banks |

2,56% |

Investment instruments |

4,16% |

Other |

15,76% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 31.12.2023 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,53% |

-- |

3M |

2,21% |

0,74% |

6M |

3,21% |

0,53% |

12M |

5,84% |

0,49% |

for the last 3 years |

19,51% |

0,54% |

for the last 5 years |

30,84% |

0,51% |

for the calendar year |

5,84% |

0,49% |

since the establishment of the fund |

52,56% |

0,54% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 31.12.2023 (class CZK) |

Value of a unit certificate |

1,5256 CZK |

Fund capital |

16 649 407 324,36 CZK |

Current number of unit certificates issued |

10 913 646 440ks |

Current number of unit certificates issued |

13 547 583 420ks |

Total number of unit certificates redeemed |

2 633 936 980ks |

| Data as of | 01.01.2024 - 31.01.2024 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

164 782 956ks |

Number of unit certificates redeemed for the period |

73 613 839ks |

Amount for which the unit certificates were issued |

251 392 895,46 CZK |

Amount for which the unit certificates were redeemed |

112 305 272,74 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31.12.2023 (whole fund) |

Fund capital |

17 191 450 488,00 CZK |

Total assets |

17 802 395 934,18 CZK |

Of which: |

|

Real estate and real estate companies |

58,58% |

Loans to real estate companies (including interest on loans) |

19,63% |

Deposits in banks |

2,02% |

Investment instruments |

4,20% |

Other |

15,57% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 30.11.2023 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

1,30% |

-- |

3M |

1,95% |

0,65% |

6M |

3,40% |

0,57% |

12M |

5,48% |

0,46% |

for the last 3 years |

20,17% |

0,56% |

for the last 5 years |

30,61% |

0,51% |

for the calendar year |

5,28% |

0,48% |

since the establishment of the fund |

51,75% |

0,53% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 30.11.2023 (class CZK) |

Value of a unit certificate |

1,5175 CZK |

Fund capital |

16 411 502 397,02 CZK |

Current number of unit certificates issued |

10 815 059 997ks |

Current number of unit certificates issued |

13 367 558 144ks |

Total number of unit certificates redeemed |

2 552 498 147ks |

| Data as of | 01.12.2023 - 31.12.2023 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

180 025 276ks |

Number of unit certificates redeemed for the period |

81 438 833ks |

Amount for which the unit certificates were issued |

273 188 451,51 CZK |

Amount for which the unit certificates were redeemed |

123 583 430,34 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 30.11.2023 (whole fund) |

Fund capital |

16 945 641 826,98 CZK |

Total assets |

17 425 563 936,05 CZK |

Of which: |

|

Real estate and real estate companies |

58,17% |

Loans to real estate companies (including interest on loans) |

19,78% |

Deposits in banks |

2,72% |

Investment instruments |

4,27% |

Other |

15,06% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 31.10.2023 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,36% |

-- |

3M |

1,08% |

0,36% |

6M |

2,41% |

0,40% |

12M |

4,50% |

0,37% |

for the last 3 years |

18,40% |

0,51% |

for the last 5 years |

30,85% |

0,51% |

for the calendar year |

3,93% |

0,39% |

since the establishment of the fund |

49,80% |

0,52% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 31.10.2023 (class CZK) |

Value of a unit certificate |

1,4980 CZK |

Fund capital |

16 020 288 422,54 CZK |

Current number of unit certificates issued |

10 694 657 324ks |

Current number of unit certificates issued |

13 169 584 375ks |

Total number of unit certificates redeemed |

2 474 927 051ks |

| Data as of | 01.11.2023 - 30.11.2023 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

197 973 769ks |

Number of unit certificates redeemed for the period |

77 571 096ks |

Amount for which the unit certificates were issued |

296 564 739,39 CZK |

Amount for which the unit certificates were redeemed |

116 201 501,75 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31.10.2023 (whole fund) |

Fund capital |

16 514 889 059,32 CZK |

Total assets |

17 162 060 734,94 CZK |

Of which: |

|

Real estate and real estate companies |

58,38% |

Loans to real estate companies (including interest on loans) |

20,11% |

Deposits in banks |

2,89% |

Investment instruments |

4,31% |

Other |

14,31% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 30.9.2023 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,28% |

-- |

3M |

0,97% |

0,32% |

6M |

2,32% |

0,39% |

12M |

4,69% |

0,39% |

for the last 3 years |

18,58% |

0,52% |

for the last 5 years |

30,51% |

0,51% |

for the calendar year |

3,55% |

0,39% |

since the establishment of the fund |

49,26% |

0,52% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 30.9.2023 (class CZK) |

Value of a unit certificate |

1,4926 CZK |

Fund capital |

15 820 885 777,83 CZK |

Current number of unit certificates issued |

10 599 835 472ks |

Current number of unit certificates issued |

13 002 456 116ks |

Total number of unit certificates redeemed |

2 402 620 644ks |

| Data as of | 01.10.2023 - 31.10.2023 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

167 128 259ks |

Number of unit certificates redeemed for the period |

72 306 407ks |

Amount for which the unit certificates were issued |

249 455 644,92 CZK |

Amount for which the unit certificates were redeemed |

107 924 543,11 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 30.9.2023 (whole fund) |

Fund capital |

16 286 632 982,52 CZK |

Total assets |

16 828 560 842,61 CZK |

Of which: |

|

Real estate and real estate companies |

58,71% |

Loans to real estate companies (including interest on loans) |

20,44% |

Deposits in banks |

2,73% |

Investment instruments |

4,38% |

Other |

13,74% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 31.8.2023 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,44% |

-- |

3M |

1,42% |

0,47% |

6M |

2,41% |

0,40% |

12M |

5,19% |

0,43% |

for the last 3 years |

19,39% |

0,54% |

for the last 5 years |

30,55% |

0,51% |

for the calendar year |

3,27% |

0,41% |

since the establishment of the fund |

48,85% |

0,52% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 31.8.2023 (class CZK) |

Value of a unit certificate |

1,4885 CZK |

Fund capital |

15 620 075 560,09 CZK |

Current number of unit certificates issued |

10 493 573 507ks |

Current number of unit certificates issued |

12 823 339 339ks |

Total number of unit certificates redeemed |

2 329 765 832ks |

| Data as of | 01.09.2023 - 30.09.2023 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

179 116 777ks |

Number of unit certificates redeemed for the period |

72 854 812ks |

Amount for which the unit certificates were issued |

266 615 340,51 CZK |

Amount for which the unit certificates were redeemed |

108 444 387,60 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31.8.2023 (whole fund) |

Fund capital |

16 052 399 408,31 CZK |

Total assets |

16 526 020 983,17 CZK |

Of which: |

|

Real estate and real estate companies |

58,91% |

Loans to real estate companies (including interest on loans) |

20,87% |

Deposits in banks |

3,02% |

Investment instruments |

4,43% |

Other |

12,77% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 31.7.2023 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,26% |

-- |

3M |

1,31% |

0,44% |

6M |

2,41% |

0,40% |

12M |

5,46% |

0,45% |

for the last 3 years |

19,04% |

0,53% |

for the last 5 years |

30,10% |

0,50% |

for the calendar year |

2,82% |

0,40% |

since the establishment of the fund |

48,20% |

0,52% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 31.7.2023 (class CZK) |

Value of a unit certificate |

1,4820 CZK |

Fund capital |

15 412 837 730,27 CZK |

Current number of unit certificates issued |

10 399 828 524ks |

Current number of unit certificates issued |

12 671 578 092ks |

Total number of unit certificates redeemed |

2 271 749 568ks |

| Data as of | 01.08.2023 - 31.08.2023 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

151 761 247ks |

Number of unit certificates redeemed for the period |

58 016 264ks |

Amount for which the unit certificates were issued |

224 910 165,42 CZK |

Amount for which the unit certificates were redeemed |

85 980 103,34 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31.7.2023 (whole fund) |

Fund capital |

15 826 070 013,75 CZK |

Total assets |

16 588 710 831,93 CZK |

Of which: |

|

Real estate and real estate companies |

59,45% |

Loans to real estate companies (including interest on loans) |

20,66% |

Deposits in banks |

2,63% |

Investment instruments |

4,39% |

Other |

12,87% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 30.6.2023 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,72% |

-- |

3M |

1,34% |

0,45% |

6M |

2,55% |

0,43% |

12M |

6,23% |

0,52% |

for the last 3 years |

18,86% |

0,52% |

for the last 5 years |

30,25% |

0,50% |

for the calendar year |

2,55% |

0,43% |

since the establishment of the fund |

47,82% |

0,52% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 30.6.2023 (class CZK) |

Value of a unit certificate |

1,4782 CZK |

Fund capital |

15 170 561 191,87 CZK |

Current number of unit certificates issued |

10 262 838 385ks |

Current number of unit certificates issued |

12 459 019 459ks |

Total number of unit certificates redeemed |

2 196 181 074ks |

| Data as of | 01.07.2023 - 31.07.2023 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

212 558 633ks |

Number of unit certificates redeemed for the period |

75 568 494ks |

Amount for which the unit certificates were issued |

314 204 150,89 CZK |

Amount for which the unit certificates were redeemed |

111 705 348,01 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 30.6.2023 (whole fund) |

Fund capital |

15 558 550 605,75 CZK |

Total assets |

16 615 923 768,54 CZK |

Of which: |

|

Real estate and real estate companies |

53,87% |

Loans to real estate companies (including interest on loans) |

19,58% |

Deposits in banks |

7,78% |

Investment instruments |

4,36% |

Other |

14,41% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 31.5.2023 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,33% |

-- |

3M |

0,97% |

0,32% |

6M |

2,02% |

0,34% |

12M |

7,24% |

0,60% |

for the last 3 years |

18,22% |

0,51% |

for the last 5 years |

31,90% |

0,53% |

for the calendar year |

1,82% |

0,36% |

since the establishment of the fund |

46,76% |

0,51% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 31.5.2023 (class CZK) |

Value of a unit certificate |

1,4676 CZK |

Fund capital |

14 879 518 725,88 CZK |

Current number of unit certificates issued |

10 138 425 874ks |

Current number of unit certificates issued |

12 254 369 893ks |

Total number of unit certificates redeemed |

2 115 944 019ks |

| Data as of | 01.06.2023 - 30.06.2023 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

204 649 566ks |

Number of unit certificates redeemed for the period |

80 237 055ks |

Amount for which the unit certificates were issued |

300 343 719,42 CZK |

Amount for which the unit certificates were redeemed |

117 755 902,11 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31.5.2023 (whole fund) |

Fund capital |

15 237 388 575,80 CZK |

Total assets |

16 203 655 743,33 CZK |

Of which: |

|

Real estate and real estate companies |

53,99% |

Loans to real estate companies (including interest on loans) |

20,53% |

Deposits in banks |

5,34% |

Investment instruments |

4,45% |

Other |

15,69% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 30.4.2023 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,28% |

-- |

3M |

1,08% |

0,36% |

6M |

2,04% |

0,34% |

12M |

7,06% |

0,59% |

for the last 3 years |

18,18% |

0,50% |

for the last 5 years |

31,57% |

0,53% |

for the calendar year |

1,48% |

0,37% |

since the establishment of the fund |

46,28% |

0,51% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 30.4.2023 (class CZK) |

Value of a unit certificate |

1,4628 CZK |

Fund capital |

14 677 647 716,60 CZK |

Current number of unit certificates issued |

10 034 163 615ks |

Current number of unit certificates issued |

12 084 183 490ks |

Total number of unit certificates redeemed |

2 050 019 875ks |

| Data as of | 01.05.2023 - 31.05.2023 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

170 186 403ks |

Number of unit certificates redeemed for the period |

65 924 144ks |

Amount for which the unit certificates were issued |

248 948 644,53 CZK |

Amount for which the unit certificates were redeemed |

96 433 837,76 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 30.4.2023 (whole fund) |

Fund capital |

15 017 439 119,86 CZK |

Total assets |

16 035 051 151,11 CZK |

Of which: |

|

Real estate and real estate companies |

53,42% |

Loans to real estate companies (including interest on loans) |

21,15% |

Deposits in banks |

5,49% |

Investment instruments |

4,47% |

Other |

15,47% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 31.3.2023 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,36% |

-- |

3M |

1,20% |

0,40% |

6M |

2,31% |

0,39% |

12M |

7,17% |

0,60% |

for the last 3 years |

18,11% |

0,50% |

for the last 5 years |

31,12% |

0,52% |

for the calendar year |

1,20% |

0,40% |

since the establishment of the fund |

45,87% |

0,52% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 31.3.2023 (class CZK) |

Value of a unit certificate |

1,4587 CZK |

Fund capital |

14 434 571 551,93 CZK |

Current number of unit certificates issued |

9 895 764 562ks |

Current number of unit certificates issued |

11 854 772 809ks |

Total number of unit certificates redeemed |

1 959 008 247ks |

| Data as of | 01.04.2023 - 30.04.2023 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

229 410 681ks |

Number of unit certificates redeemed for the period |

91 011 628ks |

Amount for which the unit certificates were issued |

334 641 391,47 CZK |

Amount for which the unit certificates were redeemed |

132 758 662,05 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31.3.2023 (whole fund) |

Fund capital |

14 749 528 785,62 CZK |

Total assets |

15 880 300 655,47 CZK |

Of which: |

|

Real estate and real estate companies |

53,83% |

Loans to real estate companies (including interest on loans) |

21,24% |

Deposits in banks |

5,26% |

Investment instruments |

4,74% |

Other |

14,93% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 28.2.2023 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,44% |

-- |

3M |

1,04% |

0,35% |

6M |

2,72% |

0,45% |

12M |

7,44% |

0,62% |

for the last 3 years |

18,18% |

0,51% |

for the last 5 years |

30,66% |

0,51% |

for the calendar year |

0,84% |

0,42% |

since the establishment of the fund |

45,35% |

0,52% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 28.2.2023 (class CZK) |

Value of a unit certificate |

1,4535 CZK |

Fund capital |

14 200 399 875,79 CZK |

Current number of unit certificates issued |

9 770 029 761ks |

Current number of unit certificates issued |

11 648 887 519ks |

Total number of unit certificates redeemed |

1 878 857 758ks |

| Data as of | 01.03.2023 - 31.03.2023 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

205 885 290ks |

Number of unit certificates redeemed for the period |

80 150 489ks |

Amount for which the unit certificates were issued |

299 254 234,18 CZK |

Amount for which the unit certificates were redeemed |

116 498 735,84 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 28.2.2023 (whole fund) |

Fund capital |

14 494 839 886,26 CZK |

Total assets |

15 930 569 881,49 CZK |

Of which: |

|

Real estate and real estate companies |

53,86% |

Loans to real estate companies (including interest on loans) |

20,77% |

Deposits in banks |

7,62% |

Investment instruments |

4,70% |

Other |

13,05% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 31.1.2023 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,40% |

-- |

3M |

0,95% |

0,32% |

6M |

2,97% |

0,50% |

12M |

7,09% |

0,59% |

for the last 3 years |

18,29% |

0,51% |

for the last 5 years |

30,11% |

0,50% |

for the calendar year |

0,40% |

0,40% |

since the establishment of the fund |

44,71% |

0,51% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 31.1.2023 (class CZK) |

Value of a unit certificate |

1,4471 CZK |

Fund capital |

13 953 986 592,40 CZK |

Current number of unit certificates issued |

9 642 752 674ks |

Current number of unit certificates issued |

11 452 838 937ks |

Total number of unit certificates redeemed |

1 810 086 263ks |

| Data as of | 01.02.2023 - 28.02.2023 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

196 048 582ks |

Number of unit certificates redeemed for the period |

68 771 495ks |

Amount for which the unit certificates were issued |

283 701 939,84 CZK |

Amount for which the unit certificates were redeemed |

99 519 230,75 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31.1.2023 (whole fund) |

Fund capital |

14 234 179 457,57 CZK |

Total assets |

15 775 838 153,69 CZK |

Of which: |

|

Real estate and real estate companies |

53,49% |

Loans to real estate companies (including interest on loans) |

21,36% |

Deposits in banks |

7,58% |

Investment instruments |

4,72% |

Other |

12,85% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 31.5.2024 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

2,25% |

-- |

3M |

4,23% |

1,41% |

6M |

1,20% |

0,20% |

12M |

2,60% |

0,22% |

for the last 3 years |

19,35% |

0,54% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

2,42% |

0,48% |

since the establishment of the fund |

29,54% |

0,60% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 31.5.2024 (class EUR) |

Value of a unit certificate |

0,0592 EUR |

Fund capital |

24 555 480,45 EUR |

Current number of unit certificates issued |

415 027 246ks |

Current number of unit certificates issued |

485 512 170ks |

Total number of unit certificates redeemed |

70 484 924ks |

| Data as of | 01.06.2024 - 30.06.2024 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

5 703 192ks |

Number of unit certificates redeemed for the period |

3 375 525ks |

Amount for which the unit certificates were issued |

337 628,93 EUR |

Amount for which the unit certificates were redeemed |

199 831,11 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31.5.2024 (whole fund) |

Fund capital |

18 486 639 503,08 CZK |

Total assets |

19 015 124 207,38 CZK |

Of which: |

|

Real estate and real estate companies |

56,96% |

Loans to real estate companies (including interest on loans) |

17,60% |

Deposits in banks |

2,32% |

Investment instruments |

4,04% |

Other |

19,08% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 30.4.2024 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

1,22% |

-- |

3M |

0,70% |

0,23% |

6M |

1,22% |

0,20% |

12M |

-0,34% |

-0,03% |

for the last 3 years |

17,44% |

0,48% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

0,17% |

0,04% |

since the establishment of the fund |

26,70% |

0,56% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 30.4.2024 (class EUR) |

Value of a unit certificate |

0,0579 EUR |

Fund capital |

24 012 425,30 EUR |

Current number of unit certificates issued |

414 680 427ks |

Current number of unit certificates issued |

478 258 848ks |

Total number of unit certificates redeemed |

63 578 421ks |

| Data as of | 01.05.2024 - 31.05.2024 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

7 253 322ks |

Number of unit certificates redeemed for the period |

6 906 503ks |

Amount for which the unit certificates were issued |

419 967,40 EUR |

Amount for which the unit certificates were redeemed |

399 886,53 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 30.4.2024 (whole fund) |

Fund capital |

18 223 774 205,98 CZK |

Total assets |

18 880 731 784,78 CZK |

Of which: |

|

Real estate and real estate companies |

58,04% |

Loans to real estate companies (including interest on loans) |

18,65% |

Deposits in banks |

2,15% |

Investment instruments |

4,05% |

Other |

17,11% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 31.3.2024 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

0,70% |

-- |

3M |

-1,04% |

-0,35% |

6M |

-0,35% |

-0,06% |

12M |

-1,38% |

-0,11% |

for the last 3 years |

16,26% |

0,45% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

-1,04% |

-0,35% |

since the establishment of the fund |

25,16% |

0,54% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 31.3.2024 (class EUR) |

Value of a unit certificate |

0,0572 EUR |

Fund capital |

23 770 632,34 EUR |

Current number of unit certificates issued |

415 669 058ks |

Current number of unit certificates issued |

469 345 256ks |

Total number of unit certificates redeemed |

53 676 198ks |

| Data as of | 01.04.2024 - 30.04.2024 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

8 913 592ks |

Number of unit certificates redeemed for the period |

9 902 223ks |

Amount for which the unit certificates were issued |

509 857,57 EUR |

Amount for which the unit certificates were redeemed |

566 407,16 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31.3.2024 (whole fund) |

Fund capital |

17 953 100 715,39 CZK |

Total assets |

18 716 801 880,45 CZK |

Of which: |

|

Real estate and real estate companies |

58,40% |

Loans to real estate companies (including interest on loans) |

18,55% |

Deposits in banks |

2,56% |

Investment instruments |

4,06% |

Other |

16,43% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 29.2.2024 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

-1,22% |

-- |

3M |

-2,91% |

-0,97% |

6M |

-1,73% |

-0,29% |

12M |

-1,56% |

-0,13% |

for the last 3 years |

16,39% |

0,46% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

-1,73% |

-0,87% |

since the establishment of the fund |

24,29% |

0,53% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 29.2.2024 (class EUR) |

Value of a unit certificate |

0,0568 EUR |

Fund capital |

23 351 870,85 EUR |

Current number of unit certificates issued |

411 379 446ks |

Current number of unit certificates issued |

454 439 367ks |

Total number of unit certificates redeemed |

43 059 921ks |

| Data as of | 01.03.2024 - 31.03.2024 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

14 905 889ks |

Number of unit certificates redeemed for the period |

10 616 277ks |

Amount for which the unit certificates were issued |

846 654,09 EUR |

Amount for which the unit certificates were redeemed |

603 004,55 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 29.2.2024 (whole fund) |

Fund capital |

17 665 445 075,40 CZK |

Total assets |

18 473 414 454,61 CZK |

Of which: |

|

Real estate and real estate companies |

58,34% |

Loans to real estate companies (including interest on loans) |

19,18% |

Deposits in banks |

2,71% |

Investment instruments |

4,09% |

Other |

15,68% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 31.1.2024 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

-0,52% |

-- |

3M |

0,52% |

0,17% |

6M |

-0,69% |

-0,12% |

12M |

1,77% |

0,15% |

for the last 3 years |

18,80% |

0,52% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

-0,52% |

-0,52% |

since the establishment of the fund |

25,82% |

0,57% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 31.1.2024 (class EUR) |

Value of a unit certificate |

0,0575 EUR |

Fund capital |

22 723 322,51 EUR |

Current number of unit certificates issued |

394 913 759ks |

Current number of unit certificates issued |

436 528 321ks |

Total number of unit certificates redeemed |

41 614 562ks |

| Data as of | 01.02.2024 - 29.02.2024 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

17 911 046ks |

Number of unit certificates redeemed for the period |

1 445 359ks |

Amount for which the unit certificates were issued |

1 029 885,72 EUR |

Amount for which the unit certificates were redeemed |

83 108,16 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31.1.2024 (whole fund) |

Fund capital |

17 402 327 251,17 CZK |

Total assets |

18 093 206 981,84 CZK |

Of which: |

|

Real estate and real estate companies |

58,07% |

Loans to real estate companies (including interest on loans) |

19,45% |

Deposits in banks |

2,56% |

Investment instruments |

4,16% |

Other |

15,76% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 31.12.2023 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

-1,20% |

-- |

3M |

0,70% |

0,23% |

6M |

-0,69% |

-0,11% |

12M |

3,40% |

0,28% |

for the last 3 years |

20,42% |

0,57% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

3,40% |

0,28% |

since the establishment of the fund |

26,48% |

0,60% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 31.12.2023 (class EUR) |

Value of a unit certificate |

0,0578 EUR |

Fund capital |

21 922 878,21 EUR |

Current number of unit certificates issued |

379 311 678ks |

Current number of unit certificates issued |

417 088 281ks |

Total number of unit certificates redeemed |

37 776 603ks |

| Data as of | 01.01.2024 - 31.01.2024 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

19 440 040ks |

Number of unit certificates redeemed for the period |

3 837 959ks |

Amount for which the unit certificates were issued |

1 123 634,58 EUR |

Amount for which the unit certificates were redeemed |

221 834,04 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31.12.2023 (whole fund) |

Fund capital |

17 191 450 488,00 CZK |

Total assets |

17 802 395 934,18 CZK |

Of which: |

|

Real estate and real estate companies |

58,58% |

Loans to real estate companies (including interest on loans) |

19,63% |

Deposits in banks |

2,02% |

Investment instruments |

4,20% |

Other |

15,57% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 30.11.2023 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

2,27% |

-- |

3M |

1,21% |

0,40% |

6M |

1,39% |

0,23% |

12M |

5,79% |

0,48% |

for the last 3 years |

22,90% |

0,64% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

4,65% |

0,42% |

since the establishment of the fund |

28,01% |

0,65% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 30.11.2023 (class EUR) |

Value of a unit certificate |

0,0585 EUR |

Fund capital |

21 990 095,92 EUR |

Current number of unit certificates issued |

375 821 772ks |

Current number of unit certificates issued |

400 805 569ks |

Total number of unit certificates redeemed |

24 983 797ks |

| Data as of | 01.12.2023 - 31.12.2023 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

16 282 712ks |

Number of unit certificates redeemed for the period |

12 792 806ks |

Amount for which the unit certificates were issued |

952 539,21 EUR |

Amount for which the unit certificates were redeemed |

748 379,16 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 30.11.2023 (whole fund) |

Fund capital |

16 945 641 826,98 CZK |

Total assets |

17 425 563 936,05 CZK |

Of which: |

|

Real estate and real estate companies |

58,17% |

Loans to real estate companies (including interest on loans) |

19,78% |

Deposits in banks |

2,72% |

Investment instruments |

4,27% |

Other |

15,06% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 31.10.2023 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

-0,35% |

-- |

3M |

-1,21% |

-0,40% |

6M |

-1,55% |

-0,26% |

12M |

4,38% |

0,36% |

for the last 3 years |

24,62% |

0,68% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

2,33% |

0,23% |

since the establishment of the fund |

25,16% |

0,60% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 31.10.2023 (class EUR) |

Value of a unit certificate |

0,0572 EUR |

Fund capital |

20 138 462,41 EUR |

Current number of unit certificates issued |

352 349 304ks |

Current number of unit certificates issued |

372 913 442ks |

Total number of unit certificates redeemed |

20 564 138ks |

| Data as of | 01.11.2023 - 30.11.2023 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

27 892 127ks |

Number of unit certificates redeemed for the period |

4 419 659ks |

Amount for which the unit certificates were issued |

1 595 429,73 EUR |

Amount for which the unit certificates were redeemed |

252 804,49 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31.10.2023 (whole fund) |

Fund capital |

16 514 889 059,32 CZK |

Total assets |

17 162 060 734,94 CZK |

Of which: |

|

Real estate and real estate companies |

58,38% |

Loans to real estate companies (including interest on loans) |

20,11% |

Deposits in banks |

2,89% |

Investment instruments |

4,31% |

Other |

14,31% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 30.9.2023 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

-0,69% |

-- |

3M |

-1,37% |

-0,46% |

6M |

-1,03% |

-0,17% |

12M |

5,51% |

0,46% |

for the last 3 years |

25,60% |

0,71% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

2,68% |

0,30% |

since the establishment of the fund |

25,60% |

0,62% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 30.9.2023 (class EUR) |

Value of a unit certificate |

0,0574 EUR |

Fund capital |

19 135 053,60 EUR |

Current number of unit certificates issued |

333 316 154ks |

Current number of unit certificates issued |

352 778 850ks |

Total number of unit certificates redeemed |

19 462 696ks |

| Data as of | 01.10.2023 - 31.10.2023 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

20 134 592ks |

Number of unit certificates redeemed for the period |

1 101 442ks |

Amount for which the unit certificates were issued |

1 155 725,80 EUR |

Amount for which the unit certificates were redeemed |

63 222,78 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 30.9.2023 (whole fund) |

Fund capital |

16 286 632 982,52 CZK |

Total assets |

16 828 560 842,61 CZK |

Of which: |

|

Real estate and real estate companies |

58,71% |

Loans to real estate companies (including interest on loans) |

20,44% |

Deposits in banks |

2,73% |

Investment instruments |

4,38% |

Other |

13,74% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 31.8.2023 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

-0,17% |

-- |

3M |

0,17% |

0,06% |

6M |

0,17% |

0,03% |

12M |

7,04% |

0,59% |

for the last 3 years |

23,50% |

0,65% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

3,40% |

0,42% |

since the establishment of the fund |

26,48% |

0,66% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 31.8.2023 (class EUR) |

Value of a unit certificate |

0,0578 EUR |

Fund capital |

17 957 376,87 EUR |

Current number of unit certificates issued |

310 584 323ks |

Current number of unit certificates issued |

327 670 092ks |

Total number of unit certificates redeemed |

17 085 769ks |

| Data as of | 01.09.2023 - 30.09.2023 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

25 108 758ks |

Number of unit certificates redeemed for the period |

2 376 927ks |

Amount for which the unit certificates were issued |

1 451 286,45 EUR |

Amount for which the unit certificates were redeemed |

137 386,38 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31.8.2023 (whole fund) |

Fund capital |

16 052 399 408,31 CZK |

Total assets |

16 526 020 983,17 CZK |

Of which: |

|

Real estate and real estate companies |

58,91% |

Loans to real estate companies (including interest on loans) |

20,87% |

Deposits in banks |

3,02% |

Investment instruments |

4,43% |

Other |

12,77% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 31.7.2023 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

-0,52% |

-- |

3M |

-0,34% |

-0,11% |

6M |

2,48% |

0,41% |

12M |

8,02% |

0,67% |

for the last 3 years |

23,98% |

0,67% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

3,58% |

0,51% |

since the establishment of the fund |

26,70% |

0,68% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 31.7.2023 (class EUR) |

Value of a unit certificate |

0,0579 EUR |

Fund capital |

17 282 822,40 EUR |

Current number of unit certificates issued |

298 272 479ks |

Current number of unit certificates issued |

313 612 754ks |

Total number of unit certificates redeemed |

15 340 275ks |

| Data as of | 01.08.2023 - 31.08.2023 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

14 057 338ks |

Number of unit certificates redeemed for the period |

1 745 494ks |

Amount for which the unit certificates were issued |

813 919,98 EUR |

Amount for which the unit certificates were redeemed |

101 064,11 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31.7.2023 (whole fund) |

Fund capital |

15 826 070 013,75 CZK |

Total assets |

16 588 710 831,93 CZK |

Of which: |

|

Real estate and real estate companies |

59,45% |

Loans to real estate companies (including interest on loans) |

20,66% |

Deposits in banks |

2,63% |

Investment instruments |

4,39% |

Other |

12,87% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 30.6.2023 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

0,87% |

-- |

3M |

0,34% |

0,11% |

6M |

4,11% |

0,69% |

12M |

10,23% |

0,85% |

for the last 3 years |

26,25% |

0,73% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

4,11% |

0,69% |

since the establishment of the fund |

27,35% |

0,72% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 30.6.2023 (class EUR) |

Value of a unit certificate |

0,0582 EUR |

Fund capital |

16 350 164,93 EUR |

Current number of unit certificates issued |

280 942 914ks |

Current number of unit certificates issued |

293 328 266ks |

Total number of unit certificates redeemed |

12 385 352ks |

| Data as of | 01.07.2023 - 31.07.2023 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

20 284 488ks |

Number of unit certificates redeemed for the period |

2 954 923ks |

Amount for which the unit certificates were issued |

1 180 556,98 EUR |

Amount for which the unit certificates were redeemed |

171 976,49 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 30.6.2023 (whole fund) |

Fund capital |

15 558 550 605,75 CZK |

Total assets |

16 615 923 768,54 CZK |

Of which: |

|

Real estate and real estate companies |

53,87% |

Loans to real estate companies (including interest on loans) |

19,58% |

Deposits in banks |

7,78% |

Investment instruments |

4,36% |

Other |

14,41% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 31.5.2023 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

-0,69% |

-- |

3M |

0,00% |

0,00% |

6M |

4,34% |

0,72% |

12M |

10,75% |

0,90% |

for the last 3 years |

25,71% |

0,71% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

3,22% |

0,64% |

since the establishment of the fund |

26,26% |

0,71% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 31.5.2023 (class EUR) |

Value of a unit certificate |

0,0577 EUR |

Fund capital |

15 071 377,13 EUR |

Current number of unit certificates issued |

261 078 977ks |

Current number of unit certificates issued |

272 204 134ks |

Total number of unit certificates redeemed |

11 125 157ks |

| Data as of | 01.06.2023 - 30.06.2023 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

21 124 132ks |

Number of unit certificates redeemed for the period |

1 260 195ks |

Amount for which the unit certificates were issued |

1 218 862,12 EUR |

Amount for which the unit certificates were redeemed |

72 713,24 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31.5.2023 (whole fund) |

Fund capital |

15 237 388 575,80 CZK |

Total assets |

16 203 655 743,33 CZK |

Of which: |

|

Real estate and real estate companies |

53,99% |

Loans to real estate companies (including interest on loans) |

20,53% |

Deposits in banks |

5,34% |

Investment instruments |

4,45% |

Other |

15,69% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 30.4.2023 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

0,17% |

-- |

3M |

2,83% |

0,94% |

6M |

6,02% |

1,00% |

12M |

11,30% |

0,94% |

for the last 3 years |

27,13% |

0,75% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

3,94% |

0,98% |

since the establishment of the fund |

27,13% |

0,75% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 30.4.2023 (class EUR) |

Value of a unit certificate |

0,0581 EUR |

Fund capital |

14 456 132,88 EUR |

Current number of unit certificates issued |

248 793 437ks |

Current number of unit certificates issued |

258 654 145ks |

Total number of unit certificates redeemed |

9 860 708ks |

| Data as of | 01.05.2023 - 31.05.2023 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

13 549 989ks |

Number of unit certificates redeemed for the period |

1 264 449ks |

Amount for which the unit certificates were issued |

787 254,72 EUR |

Amount for which the unit certificates were redeemed |

73 464,49 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 30.4.2023 (whole fund) |

Fund capital |

15 017 439 119,86 CZK |

Total assets |

16 035 051 151,11 CZK |

Of which: |

|

Real estate and real estate companies |

53,42% |

Loans to real estate companies (including interest on loans) |

21,15% |

Deposits in banks |

5,49% |

Investment instruments |

4,47% |

Other |

15,47% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 31.3.2023 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

0,52% |

-- |

3M |

3,76% |

1,25% |

6M |

6,62% |

1,10% |

12M |

10,69% |

0,89% |

for the last 3 years |

0,00% |

0,00% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

3,76% |

1,25% |

since the establishment of the fund |

26,91% |

0,77% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 31.3.2023 (class EUR) |

Value of a unit certificate |

0,0580 EUR |

Fund capital |

13 408 141,07 EUR |

Current number of unit certificates issued |

231 292 138ks |

Current number of unit certificates issued |

238 142 983ks |

Total number of unit certificates redeemed |

6 850 845ks |

| Data as of | 01.04.2023 - 30.04.2023 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

20 511 162ks |

Number of unit certificates redeemed for the period |

3 009 863ks |

Amount for which the unit certificates were issued |

1 189 647,49 EUR |

Amount for which the unit certificates were redeemed |

174 572,07 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31.3.2023 (whole fund) |

Fund capital |

14 749 528 785,62 CZK |

Total assets |

15 880 300 655,47 CZK |

Of which: |

|

Real estate and real estate companies |

53,83% |

Loans to real estate companies (including interest on loans) |

21,24% |

Deposits in banks |

5,26% |

Investment instruments |

4,74% |

Other |

14,93% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 28.2.2023 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

2,12% |

-- |

3M |

4,34% |

1,45% |

6M |

6,85% |

1,14% |

12M |

12,26% |

1,02% |

for the last 3 years |

0,00% |

0,00% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

3,22% |

1,61% |

since the establishment of the fund |

26,26% |

0,77% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 28.2.2023 (class EUR) |

Value of a unit certificate |

0,0577 EUR |

Fund capital |

12 532 028,54 EUR |

Current number of unit certificates issued |

217 051 461ks |

Current number of unit certificates issued |

223 871 374ks |

Total number of unit certificates redeemed |

6 819 913ks |

| Data as of | 01.03.2023 - 31.03.2023 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

14 271 609ks |

Number of unit certificates redeemed for the period |

30 932ks |

Amount for which the unit certificates were issued |

823 471,73 EUR |

Amount for which the unit certificates were redeemed |

1 784,77 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 28.2.2023 (whole fund) |

Fund capital |

14 494 839 886,26 CZK |

Total assets |

15 930 569 881,49 CZK |

Of which: |

|

Real estate and real estate companies |

53,86% |

Loans to real estate companies (including interest on loans) |

20,77% |

Deposits in banks |

7,62% |

Investment instruments |

4,70% |

Other |

13,05% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 31.1.2023 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

1,07% |

-- |

3M |

3,10% |

1,03% |

6M |

5,41% |

0,90% |

12M |

6,40% |

0,53% |

for the last 3 years |

0,00% |

0,00% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

1,07% |

1,07% |

since the establishment of the fund |

23,63% |

0,72% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 31.1.2023 (class EUR) |

Value of a unit certificate |

0,0565 EUR |

Fund capital |

11 777 758,10 EUR |

Current number of unit certificates issued |

208 306 753ks |

Current number of unit certificates issued |

214 985 182ks |

Total number of unit certificates redeemed |

6 678 429ks |

| Data as of | 01.02.2023 - 28.02.2023 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

8 886 192ks |

Number of unit certificates redeemed for the period |

141 484ks |

Amount for which the unit certificates were issued |

502 070,05 EUR |

Amount for which the unit certificates were redeemed |

7 993,85 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31.1.2023 (whole fund) |

Fund capital |

14 234 179 457,57 CZK |

Total assets |

15 775 838 153,69 CZK |

Of which: |

|

Real estate and real estate companies |

53,49% |

Loans to real estate companies (including interest on loans) |

21,36% |

Deposits in banks |

7,58% |

Investment instruments |

4,72% |

Other |

12,85% |

|

Fund class performance for INVESTMENT |

||

|---|---|---|

| data as of 31.5.2024 | Total cumulative performance of the fund (class INVESTMENT) | Average monthly performance of the fund (class INVESTMENT) |

1M |

0,41% |

-- |

3M |

1,72% |

0,57% |

6M |

0,00% |

0,00% |

12M |

0,00% |

0,00% |

for the last 3 years |

0,00% |

0,00% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

0,00% |

0,00% |

since the establishment of the fund |

1,72% |

0,57% |

| Price per Certificate Unit třídy INVESTMENT | |

|---|---|

| Data as of | 31.5.2024 (class INVESTMENT) |

Value of a unit certificate |

1,5616 CZK |

Fund capital |

391 107,46 CZK |